Are Men’s Watches a Good Investment?

Investing is all about making informed choices, and when it comes to men’s watches, there’s a lot to consider. From craftsmanship to brand reputation, each factor can influence the potential return on investment. In this blog, we’ll explore the facets that make men’s watches worth considering as an investment.

Understanding the Market for Men’s Watches

Familiarize yourself with the overall market trends and how they influence the value of men’s watches.

The watch market has evolved significantly, melding traditional craftsmanship with modern technology. As buyers become more discerning, understanding market dynamics is crucial for anyone considering investing in men’s watches.

Prices can fluctuate based on multiple factors, including economic trends and consumer demand. Thus, keeping an eye on industry reports, auctions, and sales can provide insights into which watches might not only hold value but also appreciate over time.

Moreover, luxury watches often merge art and engineering, making them a unique asset class. The allure of owning a timeless piece often outweighs mere numbers, adding emotional value to the monetary aspect.

Identifying Popular Brands

Research top brands known for retaining value over time, such as Rolex, Omega, and Patek Philippe.

Rolex has long been deemed the cornerstone of luxury watch investments. Their limited production runs and iconic status ensure that models remain in high demand through the years, often fetching prices well above their original retail cost.

Omega, known for precision and innovation, also holds a strong position in the investment arena. The Seamaster and Speedmaster collections, for instance, are celebrated for both their historical significance and robust resale value.

Then there’s Patek Philippe, a brand synonymous with exclusivity. Their timepieces are often treasures handed down through generations, and the right model can appreciate significantly, making them particularly appealing to serious investors.

Assessing Craftsmanship and Features

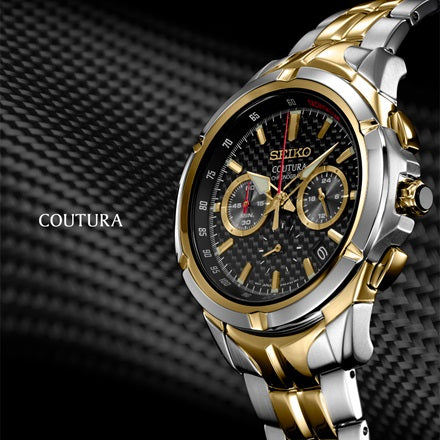

Evaluate the quality of materials, design, and unique features that can elevate a watch’s worth.

When considering a men’s watch, it’s essential to dive into what makes a timepiece exceptional. Beyond aesthetics, meticulous craftsmanship serves as a key determinant of value. Look for features such as intricate movements, original designs, and signature elements that make a watch stand out.

For instance, sapphire crystal glass generally offers higher scratch resistance compared to standard glass, enhancing longevity and therefore, value. The use of precious metals or high-tech materials in watch cases and bands can also significantly increase a model’s desirability.

Moreover, unique complications, like perpetual calendars or tourbillons, not only showcase a brand’s technical prowess but also appeal to collectors, adding another layer of investment potential to the mix.

Considering Rarity and Condition

Understand how limited editions and the condition of a watch affect its investment potential.

Rarity directly correlates with value in the watch market. Limited editions or discontinued models often become highly sought after, as collectors vie to own exclusive pieces. A watch’s rarity can transform it from a luxury accessory to a prized collectible asset.

Condition is another critical factor. A well-maintained timepiece not only signifies its integrity but also signifies that the owner values it. Factors such as scratches, original parts, and documented servicing histories can significantly influence a watch’s true market value.

To maximize an investment, ensure that any watch you consider is authentic, ideally complete with original papers and box. These components can elevate the perceived value and desirability when it comes time to sell.

Forecasting Market Trends

Stay informed about market trends to make strategic decisions on when to buy or sell.

Navigating the men’s watch market requires not just passion but also acumen in understanding market rhythms. Trends can often be cyclical, influenced by fashion, celebrity endorsements, or even technological advancements.

Monitoring auction houses and digital marketplaces provides valuable insight into which models are gaining traction and popularity. A watch that may be undervalued today could be the next big trend tomorrow, making timing crucial for any investment strategy.

Engaging with communities of watch enthusiasts can also provide firsthand insights into shifts in preferences, helping investors make informed decisions. The more educated you are about the market, the better equipped you will be to seize opportunities when they arise.

Final Thoughts

While investing in men’s watches can offer both enjoyment and potential financial returns, it’s essential to choose wisely. Factors such as brand value, watch condition, rarity, and market trends play crucial roles in determining whether a timepiece can be a reliable investment.